Performance, recovery, and outlook has varied across different sectors of the real estate industry. No matter how you read it, it’s a persuasive market. There are reasons to take action and there are reasons to wait until we land on stable ground. Either way, it’s a valuable asset at a time like this to understand the forces at play and the nuances they contain. With that baseline understanding, the task of looking forward, casting your bet and taking your place in the market simplifies, wherever your place may be.

Multi Family Real Estate Investing: An Overview

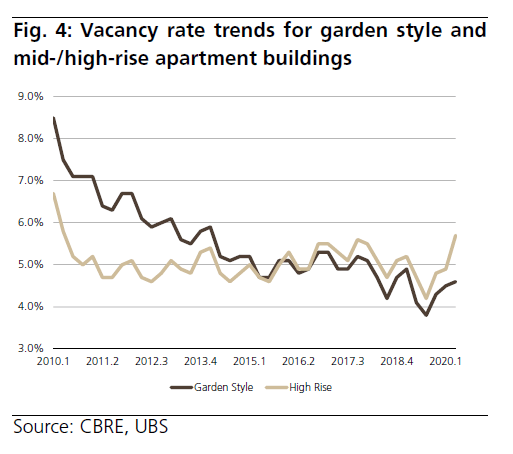

If we zoom in on the multifamily real estate world, we can see the kinds of short term losses and fragilities that have been predicted and observed in nearly every industry. A September 9th report by UBS confirmed that the Real Estate Investment Trusts (REIT) have under-performed the S&P 500 year-to-date. If, however, you zoom in on the returns of REITs, you’ll see sectors meeting different fates as the COVID-19 chips continue falling as they may.

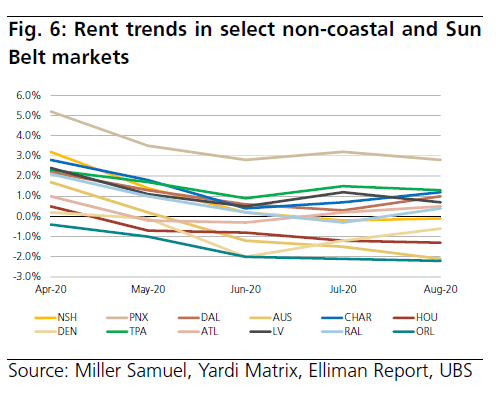

Studying rent trends in non-coastal and Sun Belt markets (DEN, PNX, ATL, HOU, ORL, etc), the same decline appears, but small climbs can be seen, and the lows are not as low.

Between The Lines: Forces At Play

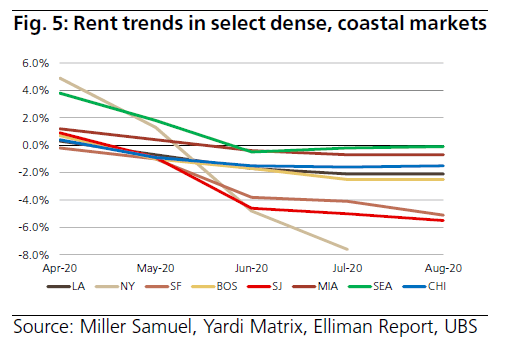

The forces shaping the multifamily real estate market are easily understood through a human lens. COVID-related job losses, the desire to socially distance in cities with less density, the ability to work remotely and the draw of more cost-efficient living in less-expensive suburban markets—all of these factors are bringing more and more people away from dense, coastal cities and toward more suburban and Sun Belt markets. This supports the under-performance of the REITs with economic exposure to California, Seattle, Boston, and New York, where vacancy is higher and rental costs are decreasing at a faster pace.

Further, many of the job losses have occurred in service positions concentrated in vacation cities like those along the Sun Belt rather than office jobs in dense cities. Still, a rebound is one thing; remote work is another. The preference toward working from home in a more affordable, less dense suburban market is a trend many experts are expecting to continue.

A Question Of Strategy, Not Timing