Along with that, high demand and low inventory have made for an incredibly competitive market, creating the head-turning effect of rising home prices throughout the pandemic. Charted against the decline in rental prices, the housing market doesn’t seem to make much sense. Nonetheless, residential real estate has performed well through COVID-19.

The short-term future, however, might not be quite as bright—it certainly won’t be a straight, upward line.

Rising Interest Rates —Factors at Play

And while this is more a fear than a reality, the increase in treasury yields was a headline-making event; higher treasury yields signal higher interest rates. Still, this is more of a temperature check than a prescription, and investors need more information before they understand how increased treasury yields, and the threat of rising interest rates, will impact mortgage rates.

Finding the Full Story

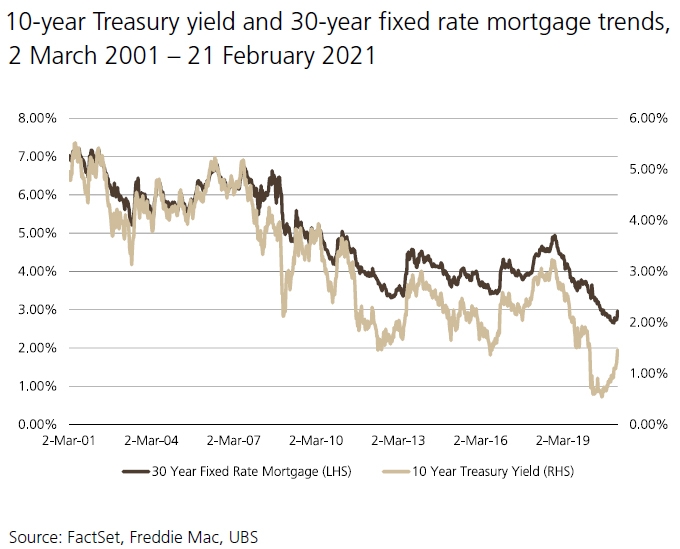

Treasury yields have a directional relationship with mortgage rates, and they’re often used as a proxy. They’re also understood as an indicator of investor confidence and sentiment around the economy. When we watch treasury yields for their mortgage rate implications, the recent rise does matter—especially because it’s happened quite quickly. But what also matters is the rate from which the yields are rising.

A recent report, by the experts at UBS, graphs the changes in treasury yields against mortgage rates and helps to expand on the real ramifications. They illustrate first that treasury yields are coming off of historically low levels. While this still puts upward pressure on mortgage rates, the effect is diminished because there’s still a wide spread between the two trends. In other words, treasury rates are rising, but they’re staying below their average level, maintaining a healthy spread.

There are also more factors affecting mortgage rates, making the relationship with treasury yields non-linear. Regulatory policy, lending policy, market initiatives, market demand, mortgage refinancing, and the availability of alternative products and lenders; these are just some of the realities to add to the equation.

Post-COVID Housing: A Short-Term Outlook

High Rates, High Hopes?

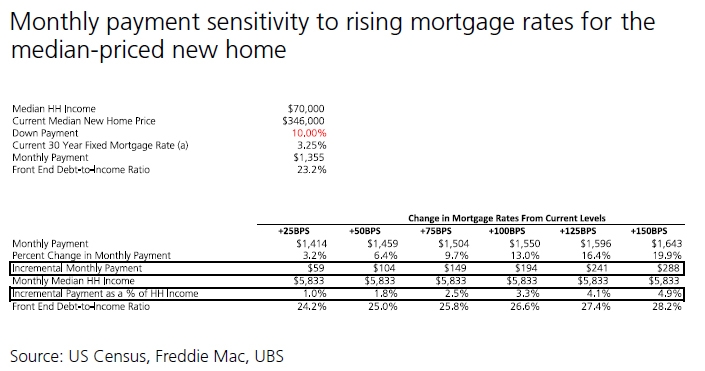

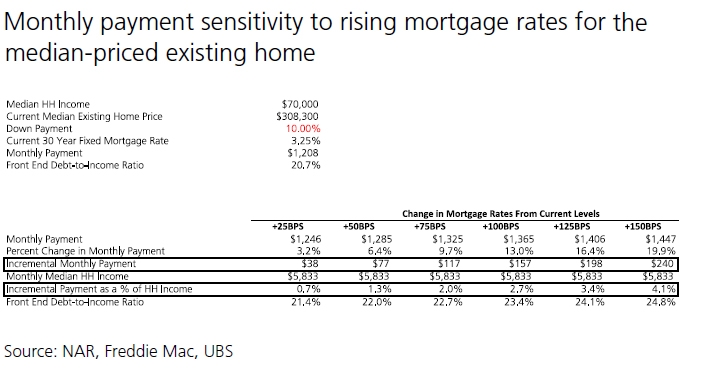

In short, it’s never quite as simple as the headlines make it seem. The chances of entering a high inflationary period after COVID-19 seem too high to discount, and the recent uptick in treasury yields forebodes some change in mortgage rates. But coming from record lows, there’s still a long way to go before the ripple effects are felt throughout the housing market.

Further, there’s reason to believe that a gradual, sustained increase could do more good than harm to the industry as a whole. Similar developments will surely make headlines as we all face the task of recovering from the economic shock and re-planning for the post-COVID market. But it’s rarely as simple as the stories make it seem, and in all likelihood, we have more room than we might think.