More Public-Private Partnership

Not only were those families displaced and set further back on their path to recovery, the forced sales and empty units flooding the market increased the supply of homes, which lead to a notable downward pressure on home prices—a negative outcome both for struggling families and for the industry at large.

An investigation into mortgage servicer practices at the time led to lengthy, grueling Congressional committee hearings and subsequent legislation that would restrict and discourage highly speculative activity.

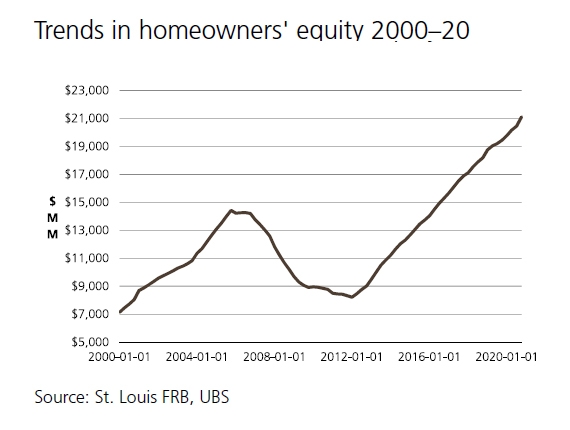

Thus, in the lead-up to this pandemic-induced downturn, home price appreciation and homeowner equity have mitigated some of the foreclosure activity we might have seen otherwise.

Forbearance, Not Forgiveness

t’s important to understand in full what the forbearance strategy offers in order to understand its longer-term effects. Different from “forgiveness,” forbearance programs allow homeowners to defer their mortgage payments using a number of mechanisms.

As the job economy continues to strengthen, homeowners can reinstate their payments when they’re able, paying any missed amounts in one lump sum, or they can establish a repayment plan to add a portion of their missed amounts onto their monthly payments.

Otherwise, they can defer their payments to the end of their loan term, and/or modify the loan to make monthly payments more manageable for their changed situation. With memories of the disastrous foreclosure rates experienced in 2008-2010 and the Congressional hearing they had to endure still fresh in their minds, mortgage servicers have taken a different approach this time around.

What the Numbers Say

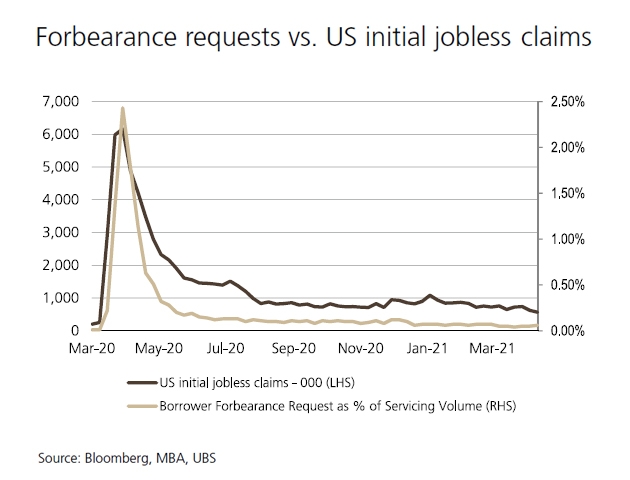

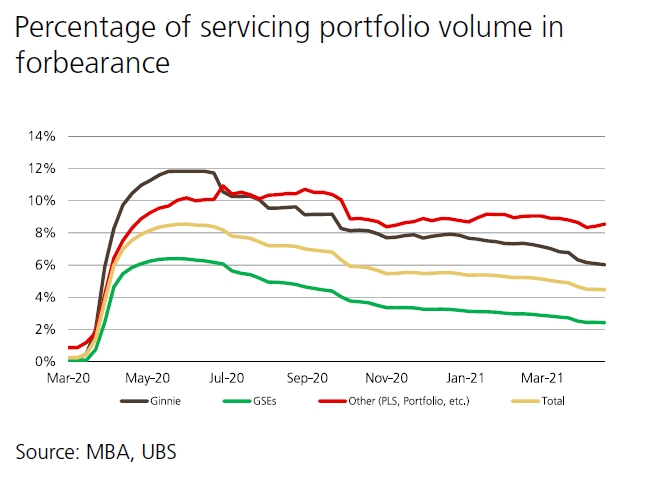

While the opening of the US economy has been slow and staggered, it’s been moving at a pace that’s still faster than experts expected. Due to the relatively swift recovery of jobs across all industries, the percentage of homeowner requests for forbearance programs has been consistently declining.

Last May, the average percentage of a mortgage servicer’s portfolio volume that was in some form of a forbearance program was at a high of 8%. This April, that number was closer to 4%—a significant improvement.

Additionally, there’s hope in how consumers have managed their forbearance programs. Of the mortgages that entered forbearance, about 45% are now performing regularly, 15% have been paid off, 5% are in active loan litigation, and less than 3% became delinquent.

The policy established by the Biden Administration to assist liquidity-constrained households will continue to impact the situation as it moves forward. With the financial crisis not far behind us, we are seeing more collaborative relationship between the Biden government and the private sector. While there might be an uptick in foreclosures when the forbearance program expires, the strength of the market as it stands bodes well for overall resilience.

The forebearance programs put in place could allow families more space and time to manage their payments, minimizing the downstream spike in supply and improving the market as a whole. Both of those factors—a strong market and more time afforded to homeowners—should make a massive difference as we continue to engineer a recovery; the real-world outcomes will only become apparent as time goes on.