Hobbs launched Stake nationally in 2020, a mobile FinTech app that helps property owners improve their net operating income (NOI) and incentivize renters to save money, earn rewards, and stay in their current rental for longer. From what Hobbs and his team have seen so far, lease-ups are happening three times faster, retention rates have jumped 7-15% higher, and profits have stabilized with increased on-time payments—all in all, an impressive feat.

I first talked with CEO and Founder Hobbs during the Shadow Ventures Showcase Multi-Family Cohort. Over the course of his career, Hobbs has advised a wide variety of types of clients seeking success in loyalty programs, including: American Express, Kroger, Weight Watchers, Macy’s, Taco Bell, and Nike, just to name a few, and he is now bringing all that industry experience to the rental real estate market.

Previously, Hobbs founded two prior start-ups—design firm Post + Beam and photo sharing service Linea. He’s now focused on transforming the real estate sector with Stake’s ‘Return on Rent’ loyalty program.

What’s At Stake?

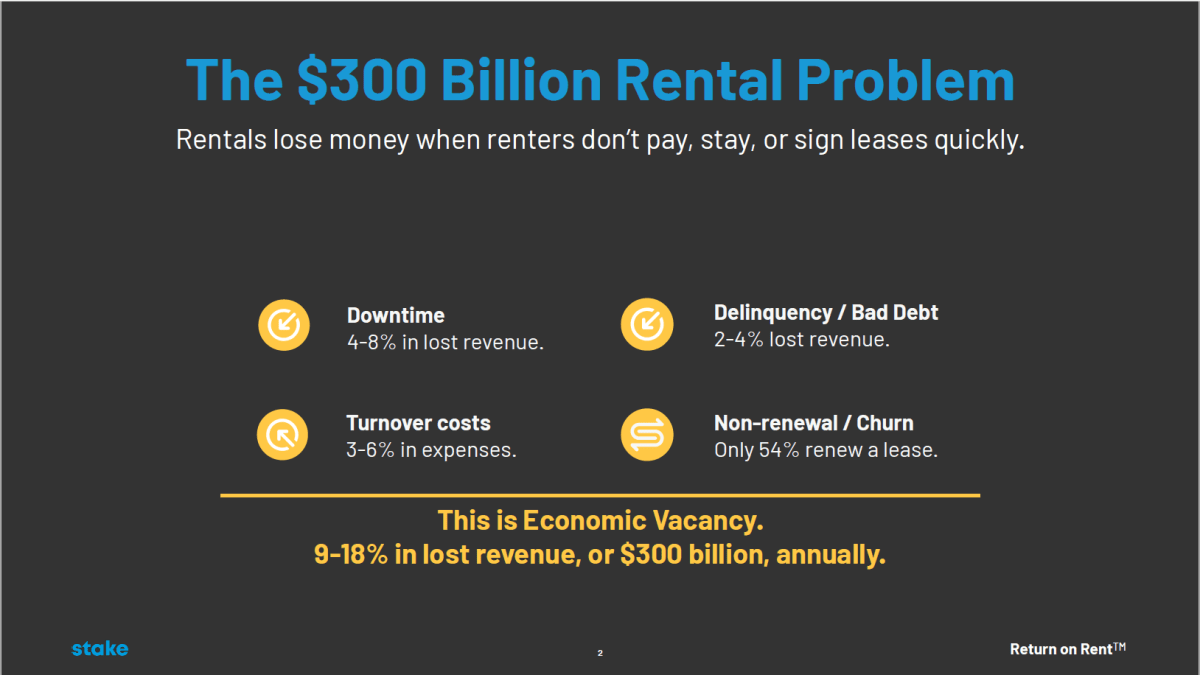

Stake is a consumer-facing FinTech app used by property owners and managers to offer highly personalized incentives to turn their tenants into long-term renters. When a renter is considering a property, it’s typical to meet with a property manager, take a tour, negotiate pricing and eventually sign a lease.

When the rental market is soft, it’s typical for consumers to be swayed by the promise of getting one month free; if you live in COVID-battered New York City, or San Francisco, you might be seeing up to three free months being handed out these days!

A True Win-Win, But How?

-

Better leasing funnel

When Stake is included in a listing, 4x more people click through. Stake also helps owners encourage prospective renters to take a tour. By offering small, instant gratification incentives for feedback and follow up, some landlords have seen a 3X increase in the tour volume of their properties. So every step in the leasing funnel is better when you make it rewarding with Stake. -

Customized Cash Back offerings

Stake’s AI technology determines exactly how much ‘cash back’ an owner should offer in order to decrease their overall costs. Because renters see the savings every month in their account, it helps property managers/owners improve relations with renters and help them build savings–sometimes for the first time in their lives! Switching to this model can cost up to 63% less than current marketing costs. Not only is this a method renters are familiar with, it’s one I think they’ll come to expect once they see it in the rental market. They’re already familiar with the tried-and-true airlines, hotels and credit card reward programs—the question will soon be asked: why not the same for my rent? -

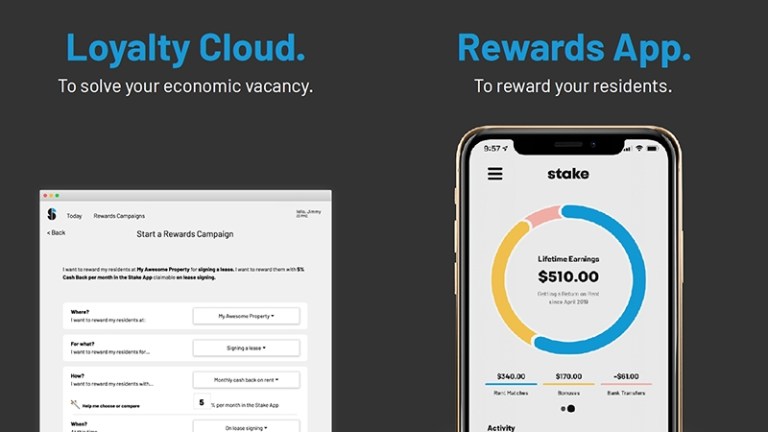

Data-Rich Loyalty Cloud

A/B split copy testing can help refine incentives for greater effectiveness. An added benefit of capturing so much data on renters is the gradual acquisition of a more complete, quantitative understanding of tenants. Landlords can use this to foster more targeted communication and stronger relationships with their tenants. -

Bonuses for On-time Payments and Renewals

Renters are incentivized to hold cash back money in the app. Outside of Stake, most renters have less than $400 in their bank and typically pay 25 to 50% of their take-home pay in rent. For 83% of Stake users, the money held in Stake represents their largest liquid savings account. -

Welcome Gifts

Gifts can be personalized to match renters’ interests, which also leads to further improving the landlord/tenant relationship. These customizable housewarming gifts can come from some of the leading online retailers, such as Chewy.com, TheSill.com, Upwork.com, DoorDash.com and others. -

Early Bird Rewards Renewal Incentives

By nurturing on-going communications and offering special loyalty incentives, Stake’s program uncovers earlier insights about potential non-renewals and information about how much a resident is willing to pay on a new lease. The program provides 7-15% better renewals and 30-75% better lease trade outs—a landlord’s dream.

In The Age of COVID-19

Property managers in metros areas who use Stake have experienced an 85% renewal rate—a feat that can’t be overstated in the pandemic era.

Renters who have been negatively impacted by COVID-19 have actually been able to tap into their Stake savings to meet their rent, taking advantage of the cushion they’d built over the 12 months prior.

The results have been clear: renters are happier, wealthier, and more secure in their rental agreements.