The Lumber Roll Over

While it wouldn’t account for all of the price movement, home repairs and remodels account from anywhere between 35% and 40% of general lumber demand. Single family home construction, by comparison, accounts for about 35%. When homeowners were kept inside during COVID-19, with more time on their hands than they could recall in recent memory, home projects surged in popularity. But the soon sky-high lumber prices undermined their enthusiasm, leading to a breakdown of bigger ticket projects like a deck or a kitchen remodel. Again, the reduction in at-home projects was one part of a larger force that brought lumber futures finally downward.

A Look Forward

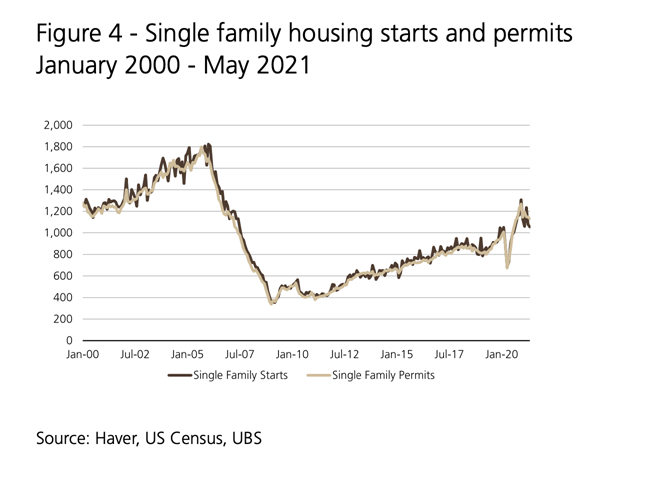

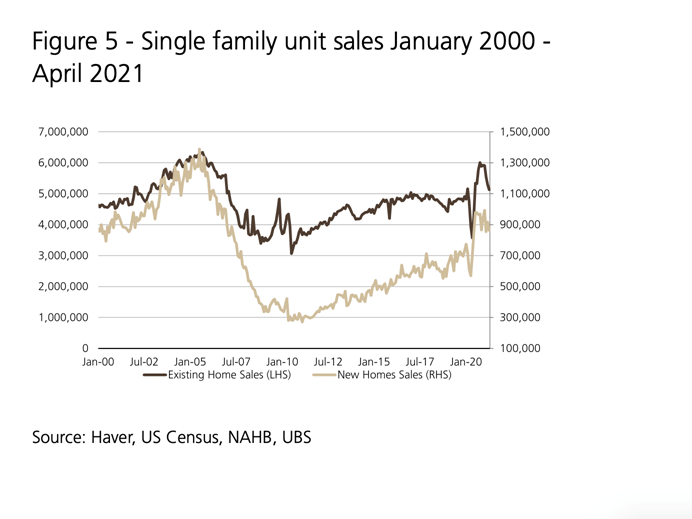

Regarding demand, all signs point to sustained strength in the housing market. There has been no wavering in single family starts and building permits, and single family unit sales continue to fly off the market.

And even during a period of high demand, inventory has remained at or below 20-year market lows.