Sunny's Vision: The Next Generation of Cities

Forward-looking Idealists

Canopy Analytics is led by co-founders Sunny Juneja, Jessica Willis and Sameer Siruguri. The Founding team had a natural mix of product talent: 2 Engineers and 1 Designer. Collectively, these individuals have created a software that simplifies and eliminates the information overload that can overwhelm those involved in the management of properties.

Canopy’s real-time system unscrambles spreadsheets and reports to reveal progress, adjust strategies, and map financial trends, ultimately achieving promised returns and driving performance while eliminating human error.

Cutting Through The Clutter

The main problems developers and investors face is the frustrating disconnect between the data and establishing insight that provides applicable goals to increase revenue and potential. How can property managers navigate all those time-consuming manual processes such as emails, spreadsheets, and reports? How can they filter out the noise and information overload for investors to utilize? The software created by Canopy Analytics cuts through the clutter, eliminates blind spots, and predicts growing market risk factors instantly, with an efficient dashboard that connects all the dots.

Canopy Analytics is also designed to foster collaborative workflow in all departments. The live, real-time dashboard can predict and prioritize issues that can decrease vacancy rates and solve local challenges that managers face on a local level. The software can convert data into prioritization alerts and daily tasks for rapid resolution.

Product-Market Fit Across All Stakeholders

- Actionable information provides a clear picture of top and bottom performers. This way, time & attention can be focused on profitability and in addressing pressing issues immediately.

- Systems integration with Yardi can be customized to automatically pull data daily, in the way you want to see it

- Market specificity allows you to rapidly compare costs by region, size, floorplan, amenities, and asset class; check on rent growth to see if units have capped out or if the market can be pushed.

- Financial reporting systems display variances in monthly budgets to align decision-making across teams, make business plan adjustments easy and track project progress that can also build up an ongoing property history

Market Size Analysis

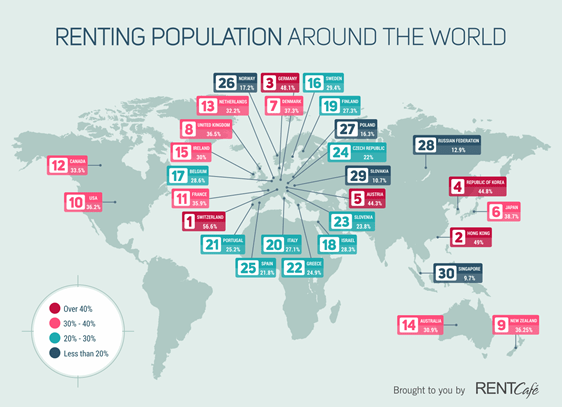

According to an SEC report filed by RealPage, the software budget that can be captured from the conventional multifamily segment sits at $500 per unit. There are an estimated 44.6M rental units in the USA according to the US Census Bureau American Housing Survey.

The global market is far larger, especially in markets where home ownership rates are shrinking. For example, 36% of the US population rent their home compared to 48% and 49% for Germany and Hong Kong, respectively.

The market size for Canopy Analytics is uncapped as long as the software continues to show how its use can increase NOI. In this respect, Canopy Analytics can unlock value in multiple categories and achieve its vision for operating and financing the next generation of cities.

CHART: RENTING POPULATION AROUND THE WORLD | CREDIT: RENT CAFE

Overall, Canopy Analytics is the future of multifamily owner-operators because it has redesigned the antiquated operating systems that were considered industry standards. In a market that has been severely impacted by the pandemic, operators need to use every advantage available to help guide them toward optimal success. Despite the challenges, there are many opportunities in the multifamily sector, and Canopy Analytics is providing customers with a competitive edge.