I’m happy to be investing in QuantmRE, a financial platform that uses real estate tokenization to help homeowners unlock the equity in their homes and provide more individualized investment opportunities for real estate investors. I’m excited about this opportunity, as I find the idea of owning a share of owner-occupied homes intriguing.

I’m happy to be investing in QuantmRE, a financial platform that uses real estate tokenization to help homeowners unlock the equity in their homes and provide more individualized investment opportunities for real estate investors. I’m excited about this opportunity, as I find the idea of owning a share of owner-occupied homes intriguing.

Typically, investors have only looked at residential real estate from the perspective of living in a property themselves or renting it out to someone else. QuantmRE’s offering is creating a new type of asset class, where investors can share in the appreciation of owner-occupied homes rather than simply focusing solely on cash flow. In this way, QuantmRE allows investors to benefit from the appreciation of prime residential real estate, without the expense and complications associated with property ownership.

QuantmRE’s tokenization process allows homeowners to partner with investors via a ‘Home Equity Agreement’ – a financial structure, protected by a lien on title, that fractionalizes the current and future value of a residence.

This creates instant liquidity for the homeowner and allows the investor to benefit from the future increase in value of the property.

For the homeowner, there is no loan and therefore no monthly payments, no interest rate charges and no added debt. Investors do not go on title as owners, so there are none of the usual ‘toilets, tenants and trash’ problems associated with the

ownership and management of rental properties. Investors are effectively silent partners in an owner-occupied home, benefiting from a share in the property’s appreciation.

The Founder

British founder Matthew Sullivan is a serial entrepreneur with a background in telecoms, technology and finance.

He has co-founded two real estate funds and worked with Richard Branson and the Virgin corporate finance team, where he was appointed Director and trustee of Virgin’s London air ambulance.

Matthew has surrounded himself with a robust team steeped in finance and blockchain experience. The team at QuantmRE is determined to become the largest blockchain-based platform to trade home equity.

Anyone who knows me is aware that I’m a big proponent of real estate tokenization and the radical change Blockchain is bringing to the sector. By leveraging Blockchain technologies, QuantmRE solves a real problem for homeowners and is opening up a previously untapped real estate asset class for investors.

Here’s why:

Greater Liquidity: Real estate has been the best performing asset class for years, but the illiquid nature of most real estate investments means the gains generated are hard to access. This presents a problem for many homeowners, and an opportunity for investors.

Traditionally, if you wanted to tap into the equity in your home, you had two choices: sell the property or apply for a home equity line of credit. Both of these options involve intricate paperwork and are time-intensive.

Applying for a reverse mortgage or proving your credit worthiness to a home equity loan officer and signing up for years of debt for the privilege of accessing your home’s equity can be equally taxing.

There is also the question of eligibility. Even though many Americans have the bulk of their wealth tied up in the equity in their homes, if they do not meet

the credit score or debt-to-income thresholds, they will be locked out from accessing their home equity via traditional mortgage lending. As interest rates rise, this is only going to become more difficult for the average homeowner.

To sell, you’d have to work with an agent, clean and strategically stage your property, wait while people wander through your house until someone decides it’s the right one for them. Then lawyers, title and insurance agents and a whole team of professionals involve themselves in the transaction (and take a hefty commission out of your pocket for their troubles). Only after months of effort and thousands of dollars spent would you access any tangible value from your home.

In many cases, people are forced to sell their homes to be able to access their home equity as they have no other option. The Home Equity Agreement structure that QuantmRE offers solves this problem, enabling people to get cash from their home equity without being forced to sell their home.

Despite the surge in equity that most homeowners have enjoyed during the pandemic, the HELOC market contracted during COVID-19. Banks like Chase, Wells Fargo and Citi looked to reduce their risks by freezing new HELOC applications. The financial crisis of 2008 led banks and homeowners alike to be much more cautious about tapping into the equity in their homes. This leaves a significant number of homeowners in a difficult position, where they see ever-increasing equity value in their homes yet are unable to access their wealth.

While interest rates remained low, cash-out refinancing became much more popular—up 33% versus a year ago according to mortgage data firm Black Knight. However, with the Fed raising interest rates and property owners swimming in tempting, untapped equity, homeowners who don’t want to give up their low mortgage rates are looking for alternatives.

Faced with the daunting task of applying for a home loan or looking at the prospect of trying something new with QuantmRE, I believe these house-rich people are now open to a new, less painful way to tap into that equity.

The HELOC has always been has been the traditional “go-to” to unlock the increased value of a home, but it’s slow, laborious and painstaking. You must gather mountains of paperwork to prove you have the income to cover loan payments, explain away any irregularities in your credit score, actually apply for the loan, meet with a loan officer to review your application, wait for an

appraisal to verify your equity, and basically sign your life away in an endless parade of paper. Finally, after weeks of waiting, you will see your money.

Contrast that with QuantmRE’s Home Equity Agreements, which are underwritten primarily on the equity in the home rather than the homeowner’s ability to borrow more money. QuantmRE can be far more flexible with the homeowner’s credit score, debt-to-income ratio and earnings, and in many cases can provide life-changing capital sums to homeowners who have been turned down by lenders.

Opening Up a Previously Untapped Asset Class to Investors: Real estate investing traditionally requires large upfront capital commitments (even if only 10 or 20% is put down on a given property), which makes real estate ownership out of reach for many. With QuantmRE’s secondary trading platform and marketplace, smaller investors can participate in tokenized Home Equity Agreements, enabling them to invest in prime residential real estate and take advantage of the unique downside protection and leveraged upside returns that are built into each Home Equity Agreement.

Home Equity Agreements Have Recently Been Securitized. In the past few months, institutions have invested over $600M in securitized Home Equity Agreements that have been originated by a handful of players. I believe this will lead to wider adoption amongst investors and homeowners, ultimately leading to a larger, more liquid marketplace that benefits homeowners and investors alike. QuantmRE is the first company to offer fractionalized Home Equity Agreements to non-institutional investors, enabling them to benefit from this exciting asset class without onerous minimums or complicated qualifying requirements.

Specific Investment Opportunities: While REITs allowed investors to diversify into real estate broadly, that type of investment is still very general in nature. Typically, one may invest in a pool of various assets specific to one sector, but they are not generally investing in one property only.

With QuantmRE’s platform, an investor can build their own portfolio of investments in hand-picked properties, because the real estate tokens are linked to a specific property which allows investors to engage more in the selection of their assets. Typically, these individual homes have not been part of the broader real estate investment scene and are currently not available for sale.

Total Addressable Market (TAM)

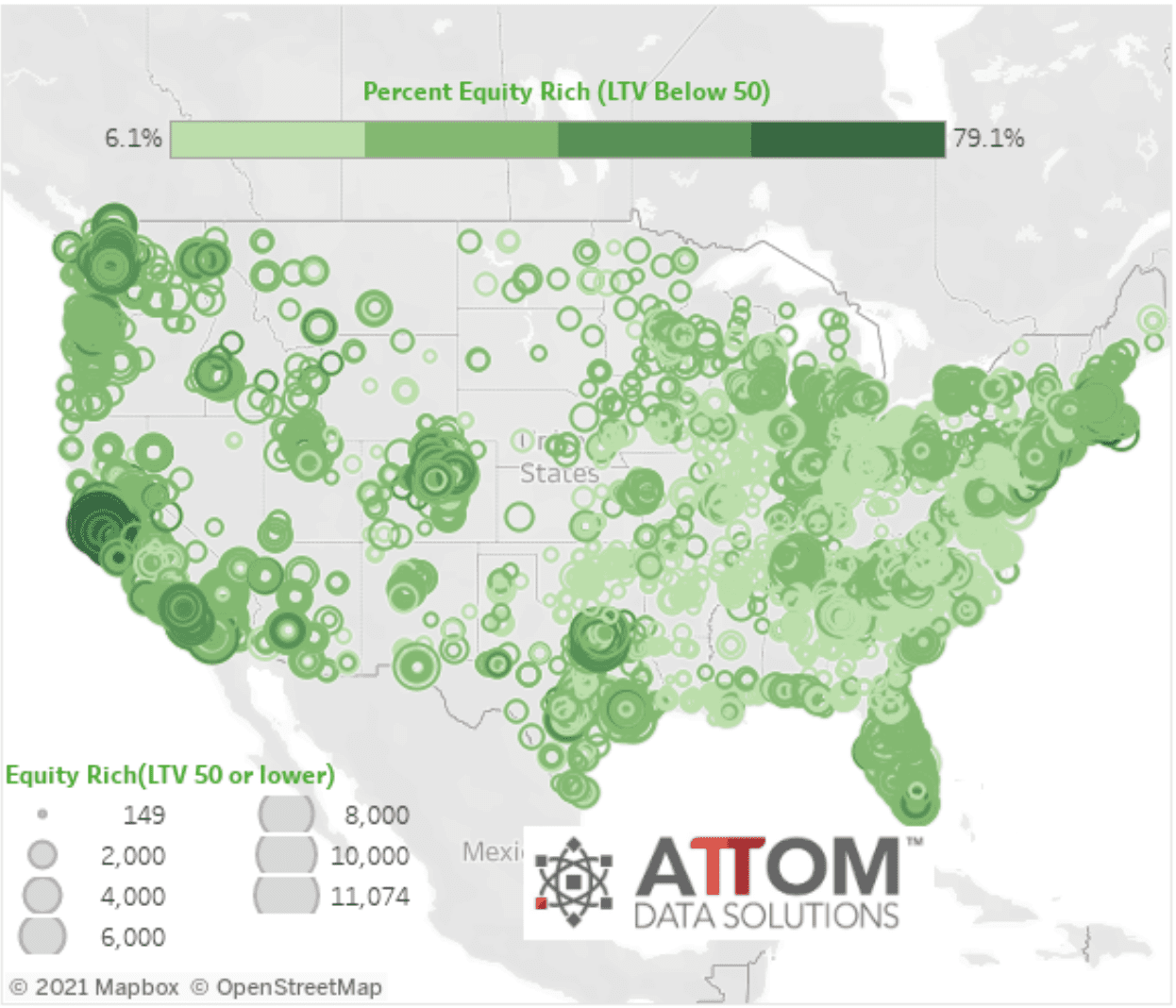

The potential market is massive. QuantmRE estimates that over 18 million homeowners have over 50% equity in their homes. These equity-rich homeowners have always had to secure traditional home equity loans or, if you’re over 62, reverse mortgages to tap that equity. Now, there’s another way.

From the investor side, REITs have been around for quite some time, but they only tap into a small portion of real estate holdings available. In 2020, it was estimated that there was over $23 trillion in untapped, off-market, owner-occupied properties, and that number has surely surged with the COVID-induced uptick in home values.

QuantmRE opens up potential access to this massive, previously untouchable market.

Leveraging the Algorand blockchain protocol – a blockchain with faster processing speeds and lower gas fees than traditional blockchains like Ethereum – QuantmRE is about to launch its secondary trading platform and marketplace to open up fractional, tokenized Home Equity Agreements to investors. This will create additional revenues for QuantmRE through listing, technology and trading fees.

So far, the company has gone through two rounds of crowdfunding, one in 2020 and one in late 2021, which was oversubscribed. They also have secured VC funding and count Algorand as one of their investors, which tells me that Algorand is excited about how they are going to use their platform.

While real estate tokenization is in its infancy, QuantmRE has been working on building their platform for over four years. They have built a trusted brand name, are revenue generating and have established a demonstrable track record in originating Home Equity Agreements. With the perfect storm of increasing interest rates and rapidly appreciating home values, I believe QuantmRE is well positioned to take advantage of the burgeoning demand from homeowners to find alternative solutions to tap into their home equity, as well as enabling a wider range of investors to participate in the previously inaccessible space of residential equity agreements.

Residential Real Estate Tokenization Opportunities Realized

As we move forward and see how fractional tokenization of real estate becomes more established, it will be exciting to see how QuantmRE will lead the way in making home equity more liquid, more accessible and easily tradable for everyone seeking a smarter way to invest in US residential real estate.