The Single Family Rental Market: Reading Between Trend Lines

The Post-COVID Family

Single Family Rentals vs Homeownership

Working from home has certainly placed new demands on ‘home.’ Many families have rushed to secure a property in a competitive market, hoping for a quick uptick in equity and unsure when the boom will come back down. But the same conditions have pushed the concept of homeownership farther away for other buyers. While home prices rose to new heights, individual and families everywhere felt the financial setbacks of the pandemic.

So, while interest rates might make monthly home payments attractive, the wealth accumulation needed for down payments, closing costs, and repair funds has been put under COVID-related duress. The following figure included in the UBS report shows home price as a multiple of household income across the last three decades. Clearly, the spike in home prices combined with the pandemic has driven that multiple upward.

Purpose Driven Development - An Investor’s Cue

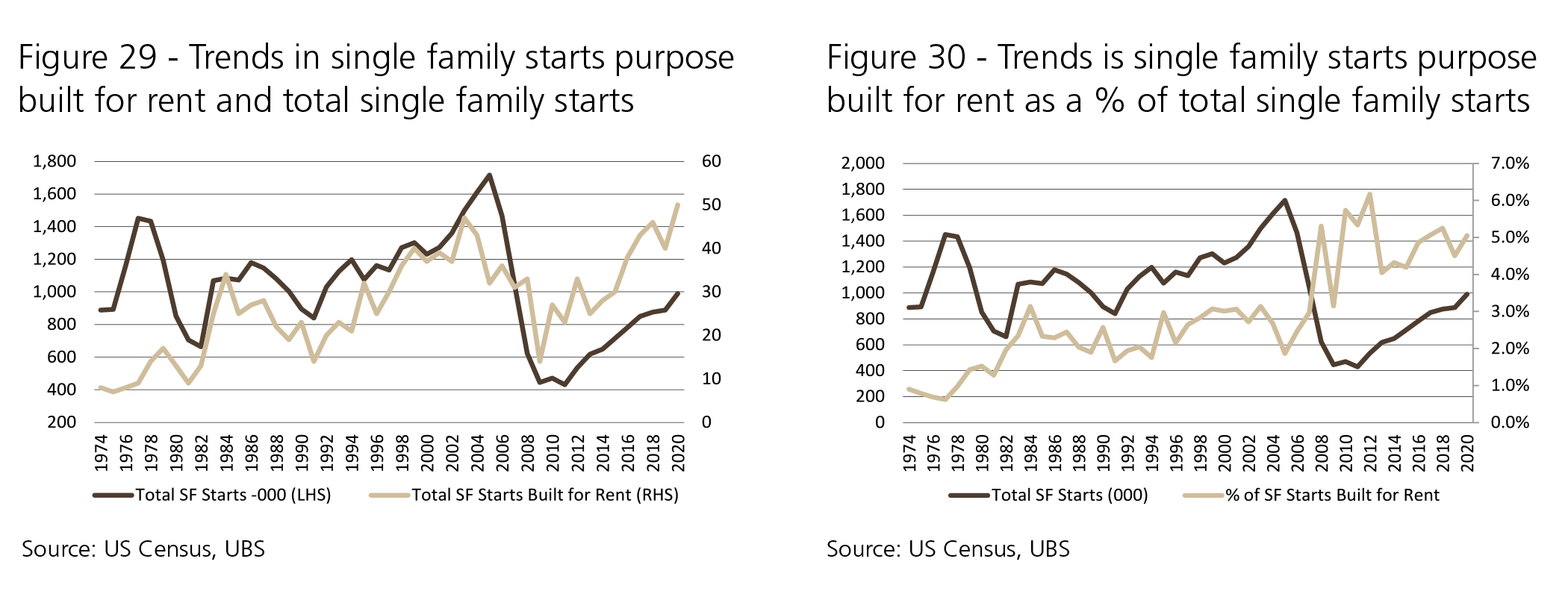

In the same UBS report, the analysts predict an increase in the development of and investing in single-family homes built specifically to rent. Considering the above demographic shifts, and the increasingly complex homeownership equation, renting is likely to continue to take up a significant part of the market. Still, the ongoing remote work movement is making the space afforded by a single-family rental more desirable, and tenants who are further along in their careers and family lives will likely opt for single family homes over multifamily units. It seems to be the perfect storm for purpose-driven development within the single-family rental sector. And we might have already seen that uptick begin.