I’m excited to share our latest acquisition — Ridgecrest Commons, a 172-unit multifamily property in Nampa, Idaho, part of the fast-growing Boise metropolitan area. We’re projecting this acquisition to generate a 16.17% IRR and 2.0x equity multiple over a five-year hold period. This off-market purchase represents a strategic investment in a market where population growth, job creation, and demand for rental housing are all on the rise.

A market ripe for investment

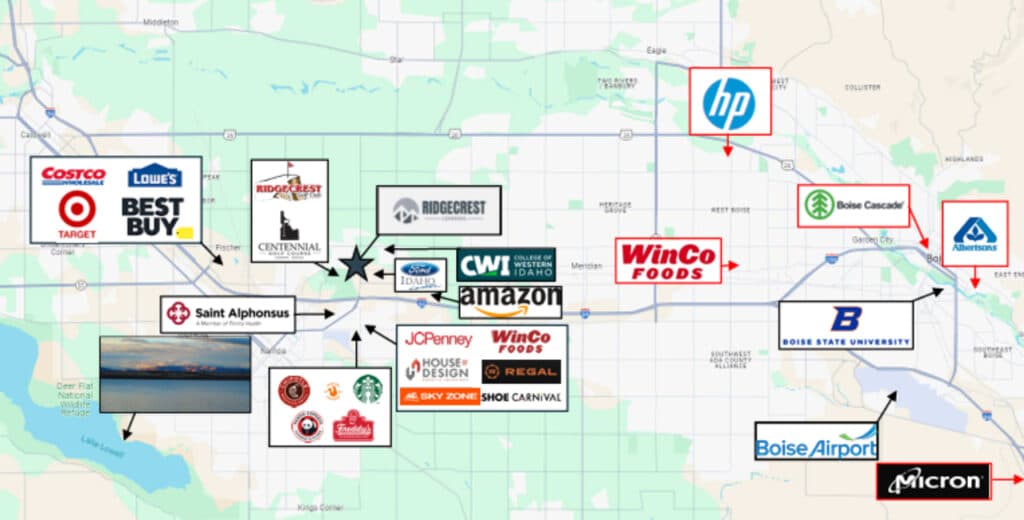

Nampa has emerged as Idaho’s fastest-growing city, with a 12.79% population increase from 2020 to 2023. This growth is fueled by the area’s affordability, strong job market, and proximity to Boise. Nampa’s appeal attracts young professionals and families seeking more space and a lower cost of living while still being close to major employment hubs like Amazon, the College of Western Idaho, and St. Alphonsus Nampa Medical Center.

What’s particularly compelling is Nampa’s future job growth, projected to reach 47.4% over the next decade, well above the national average. This trajectory is critical in driving demand for rental housing, ensuring long-term stability for properties like Ridgecrest Commons. For that reason, we saw Ridgecrest Commons as an ideal entry point into this growth market as it is positioned to benefit from Nampa’s affordability and Boise’s economic vitality.

Additionally, the Boise MSA saw an unprecedented surge in multifamily development from 2020 to 2024. Looking ahead to the next 6 to 9 months, however, the development pipeline is expected to slow significantly, creating an exceptional opportunity to acquire this asset at a time when we anticipate renewed rent growth.

Securing the right deal

We were able to purchase Ridgecrest Commons at roughly 25% below peak 2021-2022 pricing. This was possible through our strong relationships with local brokers, enabling us to negotiate directly with the seller in an off-market deal.

This kind of discount gives us a sizeable cushion, especially in today’s environment where multifamily assets in competitive markets often sell at inflated prices. Buying below replacement cost provides immediate upside. While the property is relatively new (built in two phases in 2017 and 2019), we see substantial room to enhance its value through improved management and targeted renovations.

Low-cost, fixed-rate financing

Another key aspect of this deal is the financing structure. We’re assuming Freddie Mac debt at a fixed interest rate of 2.88%, with interest-only payments through August 2025. This gives us immediate positive leverage, a rarity in the current market’s prevailing rates. By layering in a supplemental loan, we’ll bring the total loan-to-value ratio to 69%, but the blended interest rate will remain a very manageable 3.79%.

This low-cost financing is critical in maintaining healthy cash flow during the hold period and providing flexibility as we navigate potential interest rate fluctuations in the broader economy.

Enhancing value through local expertise and renovations

One of the biggest opportunities with Ridgecrest Commons is operational upside. Currently, the property is managed by a national firm with limited presence in Boise. We plan to replace them with Roundhouse Property Management, a Boise-based group managing over 3,300 units in the market. Their local expertise will help us operate the property more efficiently, reduce expenses, and better position it against local competition.

We also have a clear value-add strategy in place. Our plan includes targeted interior renovations to modernize the units with updated flooring, countertops, and appliances. These upgrades will elevate the property to compete with newer developments in the area. We expect these improvements to generate an average rental premium of $115 per unit, allowing us to capture additional value over the five-year hold period as the market continues to grow and rents rise.

Long-term outlook: Capturing Nampa’s continued growth

Ridgecrest Commons offers an excellent balance of immediate cash flow and long-term appreciation potential. The real strength of this deal lies in its resilience. The fixed-rate financing protects us from interest rate volatility, while the property’s prime location in a high-growth market ensures steady demand.

Ridgecrest Commons is exactly the kind of investment we target at Blue Field Capital: value-driven, backed by strong market fundamentals, and positioned for both short- and long-term gains. This acquisition reinforces our focus on identifying value in high-growth markets, and we’re excited to see how this property will evolve as part of our expanding multifamily portfolio.