I recently invested in Lofty, led by Jerry Chu, and also one of the largest players in the real estate tokenization space.

I’ve spent a lot of time investing in other tokenization platforms including Honey Bricks, Akru, QuantmRE and Robinland. Lofty was a compelling opportunity for me because they were the first to launch a P2P exchange which essentially allows real estate tokens to be traded like stocks.

Lofty’s core platform is breaking ground by enabling and facilitating fractional ownership of investment properties through a digital platform. They are turning property fractions into tokens that can be traded on a blockchain, allowing millions of regular people to invest in real estate with as little as $50. For comparison, competitors usually have minimum required investments as high as $1,000 or even $10,000.

As mentioned, what differentiates Lofty is that they have launched the first peer-to-peer exchange. This means that investors can not only buy tokens but trade them between themselves in this first-of-its-kind marketplace. This unique product offering is what really caught my attention.

Why I Invested in Lofty

Lofty is making real estate investment liquid and accessible for the average person. We have been hearing and talking about democratizing property investments and fractional ownership for decades but it’s only recently achievable due to the decentralized nature of the blockchain

The company is bringing innovation to a very traditional industry by working on the cross section of two large sectors, with the potential to grow even larger:

- Real estate

- Blockchain

By tokenizing segments of physical real estate properties, the Lofty model allows owners to sell properties to multiple buyers without having to navigate complex negotiations and deals. From the buyers’ perspective, this allows small-scale investors to purchase parts of investment properties and benefit from both short-term and long-term profits. It makes the process smoother, more efficient, and more accessible for both property buyers and property sellers.

Previously, investing in real estate was mostly reserved for institutional investors and other big players. Now, even individuals with average income levels can enter into this exciting and profitable world.

Something else that caught my attention in the Lofty case was the transparency in which all business is conducted. Many people get rightfully suspicious and skeptical when they hear jargon associated with blockchain and tokens. I say “rightfully” because these concepts are still very new and relatively complicated for the average person. Not to mention, the real estate industry itself is notorious for its lack of transparency around accessing information and deals.

The Lofty team has installed multiple-level mechanisms to ensure that the asymmetry between buyers and sellers has been eliminated. Inspections and appraisals are conducted by third parties and made available to interested sides. Relevant forms are filled in by property managers. In summary, all relevant information and documentation is publicly hosted.

The Lofty Team

A company is only as good as the team that starts and leads it. The way I see it, the Lofty team has everything that’s needed to fractionalize and democratize real estate investments.

Consisting of 10 members with backgrounds in real estate, technology, and finance, the Lofty team is highly diverse and all-inclusive. They have experience working for some of the largest names in the tech and finance spaces including Microsoft, Amazon, Barclays, Blackstone, and others. Their policy to hire only senior-level software engineers has allowed them to execute projects faster than comparative companies and grow at a speed that’s rarely seen.

The CEO, Jerry Chu has a strong background in AI and quantitative modeling to understand how to disrupt investments in the real estate space.

The COO, Max Ball, has extensive experience in leading both software development and growth teams in major corporations. The combination of these skills is not something that we see everyday.

The CTO, Patrick Sears, has participated in the early-stage development of the Bitcoin technology. He offers experience in both real estate and blockchain, notably leading the rebuilding of the Realtor.com website and contributing to the Bitcoin wallet source code. Now, he’s bringing this expertise to the fractionalization of real estate investment property ownership.

Market Size and Impact

Lofty estimates its total addressable market (TAM) at $1 trillion, as any residential real estate property in the US could potentially be fragmented into tokens and fractionally owned. The potential is larger when you consider the global landscape.

The business also has strong unit economics, as they charge a 6% to 10% seller fee on primary listings. The ability to charge such high margins while delivering value to investors speaks for the quality of the Lofty product. The early focus on the gross margin structure means that the company can grow quickly and turn profitable in the short term without needing to be indefinitely reliant on external venture capital funding. The Lofty product is able to take such a high gross margin as the model eliminates various layers of middlemen such as brokers, lawyers, and accountants. It’s a win-win because investors end up paying less than what they would pay in traditional middlemen fees.

Moreover, Lofty charges a 5% fee on secondary transactions between users (2.5% for the buyer, and 2.5% for the seller). This further expands the revenue potential, since these secondary transactions can be carried out well into the future. I was quite fascinated by the idea that Lofty can make up to 10% in the primary offering on each token and then a further 5% each time that token is traded (potentially unlimited number of times).

Early Success and Traction

Launched in its current form in 2021, Lofty has been on the market for just over a year. In this short time, they have already achieved some sizable accomplishments that showcase the company’s potential.

Lofty has tokenized 134 properties, resulting in a total transaction value of over $34 million. The startup has been able to do this with zero spending on marketing and minimum expenditure on other channels. The burn multiple of 0.3 is already getting them close to profitability.

I also thought it was smart that Lofty focused on tokenizing single family rental assets as this allowed them to capture a large volume of supply quickly and solve the supply side dynamics that most marketplaces struggle with.

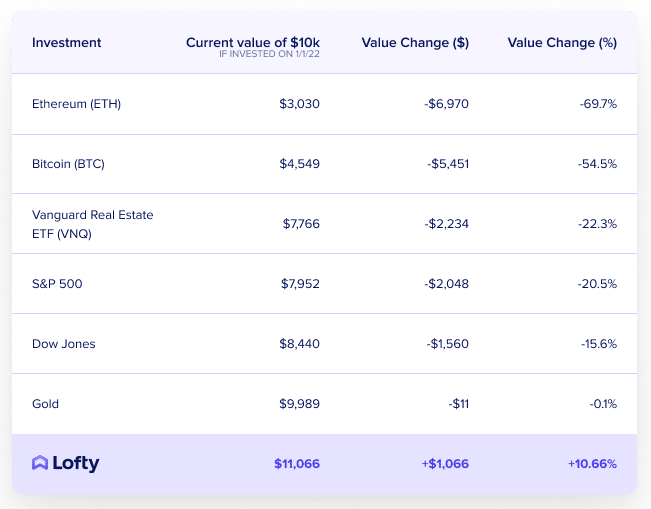

The asset class is also gaining traction, considering other alternatives. In this environment, the data suggests that tokens bought on Lofty platforms have outperformed all benchmark asset classes. For example, in the first half of the year, Lofty investments experienced a value change of +10.66%, whereas crypto investments, Vanguard Real Estate ETF, S&P 500, and Dow Jones all witnessed a negative value chain.

A positive early indicator is that Lofty has an NPS of 71 and an industry-low average churn rate of 1.17%. Customer satisfaction can play a crucial role in attracting new clients and growing the customer base. It also may bring in new employees and partners that can help accelerate the growth of the startup and take it to the next level.

By hiring only senior software developers and having a lean expenditure structure, the company is able to quickly grow and add new functionalities.

I am looking forward to seeing the great heights that Lofty can reach in the future as they lead the way for real estate to be tokenized on the blockchain.