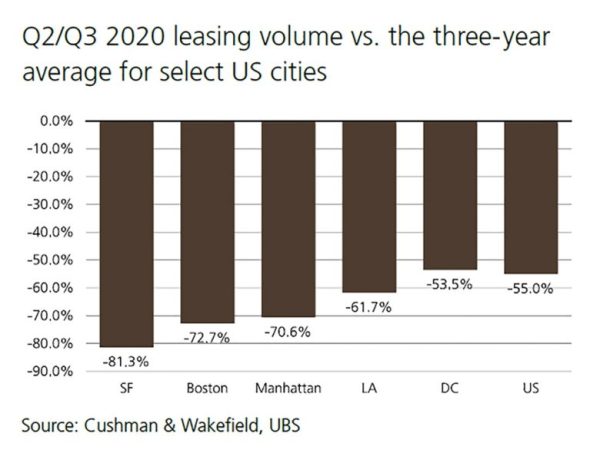

Leasing Data Indicates Serious Declines

When Cushman & Wakefield compared the leasing volume across America’s top cities to their three-year averages, the data showed staggering declines:

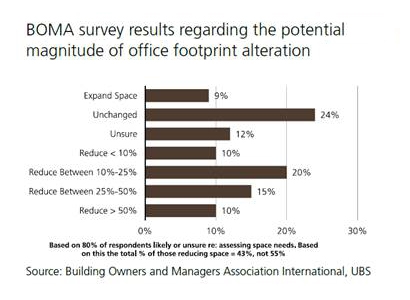

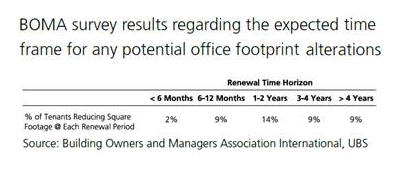

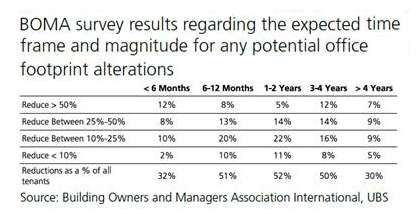

This US Office Market Report Indicates That Businesses are Planning Reductions

According to data acquired by Building Owners and Managers Association International (BOMA), many businesses are reassessing their need for office space. Researchers at BOMA conducted a survey in which 43% of businesses said they might consider downsizing their office footprint in the future; a quarter of those respondents intend to do so in the next two years. The silver lining in this office market report is the two-year timeline—real estate investors have a longer time horizon to negotiate with tenants or find alternative solutions for their holdings. But the findings of this survey overwhelmingly suggest that there will be many companies that do away with a large chunk of their physical space.

Conflicting Data

If I’ve learned one thing after many years of real estate market research, it’s that there are almost always multiple sides to the story. Despite the significance of BOMA’s results, other data suggests that the future of the office market is likely not as bleak as their numbers indicate. Many believe the widespread transition to remote working that has occurred in 2020 isn’t meant to last forever; effective collaboration, office culture, and organic mentorship are difficult to foster from a distance.

The rumblings of “Zoom fatigue” are becoming commonplace, and employees increasingly report an inability to separate their work day from their personal life. The result is an inverse effect: people no longer feel like they’re working from home, they feel like they’re living at work.

In their interpretation of these findings, UBS suspects that those who cite transportation as their primary driver live in large cities and rely on public transportation to commute to their office. The outbreak of COVID-19 has clearly made the use of public transportation a more dangerous endeavor, promoting a preference of working from home.

Similarly, participants who indicates that school closures play an important role in their preference for remote work likely have school-aged children who have likewise been impacted by COVID-19, and have a new need for daytime supervision.

Most people who work remotely do so to protect themselves and/or their families from COVID-19. In 2021, as vaccines are distributed, immunity is built, and the threat of the virus (hopefully) subsides, we have every reason to believe there will be a push for a return to normal. And for most people, that will include a return to working in-person with in-office benefits.

In their interpretation of these findings, UBS suspects that those who cite transportation as their primary driver live in large cities and rely on public transportation to commute to their office. The outbreak of COVID-19 has clearly made the use of public transportation a more dangerous endeavor, promoting a preference of working from home.

Similarly, participants who indicates that school closures play an important role in their preference for remote work likely have school-aged children who have likewise been impacted by COVID-19, and have a new need for daytime supervision.

Most people who work remotely do so to protect themselves and/or their families from COVID-19. In 2021, as vaccines are distributed, immunity is built, and the threat of the virus (hopefully) subsides, we have every reason to believe there will be a push for a return to normal. And for most people, that will include a return to working in-person with in-office benefits. Making Sense of It All

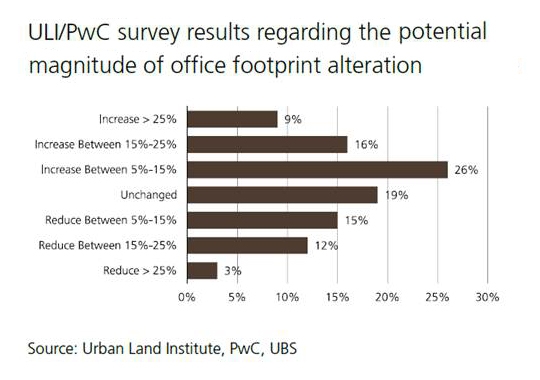

What will the office market look like in the near future? The data from BOMA and ULI/PwC seem to contradict. The former indicates a sure-fire reduction in office space, while the latter suggests that many remote workers have hopes of returning as soon as its safe.

The truth is likely somewhere in the middle, and the most probably outcome in my opinion is a combination of both. We might see many businesses adopt a hybrid approach, a home-office set up in which employees will occasionally work remotely and occasionally commute to the office. Though this might mean a reduction in office sizes or leased space across the country, the role of the office in corporate culture is far from obsolete.

Unfortunately, as we’ve already witnessed through COVID-19, the pressures of the pandemic will name winners and losers in the market. Different landlords will meet different fates as most companies shed at least some percentage of their corporate real estate overhead. Creativity and flexibility will be crucial to survival within the sector. Those who are nimble, open to new ideas and spatial usages, and those who have holdings in strong job creation markets—especially with newer, more modern office spaces—will be well positioned to see the coming era of post-pandemic real estate.